Form 1095C What is Form 1095C?Updated on 1030am by, TaxBandits For the calendar year , the IRS has updated Form 1095C with few changes It includes the introduction of new codes and lines for reporting Individual Coverage HRAsKeep in mind that this new form should be used only forCan I get a duplicate Form 1095C?

1095 C Reporting How To Use Affordability Safe Harbors For Integrity Data

1095 c form 2020 reporting

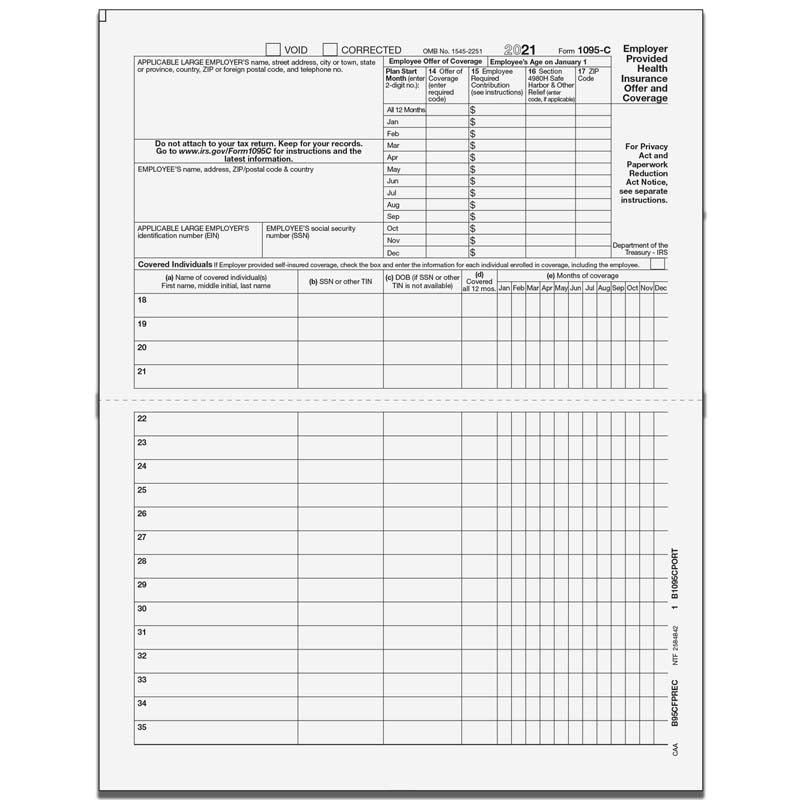

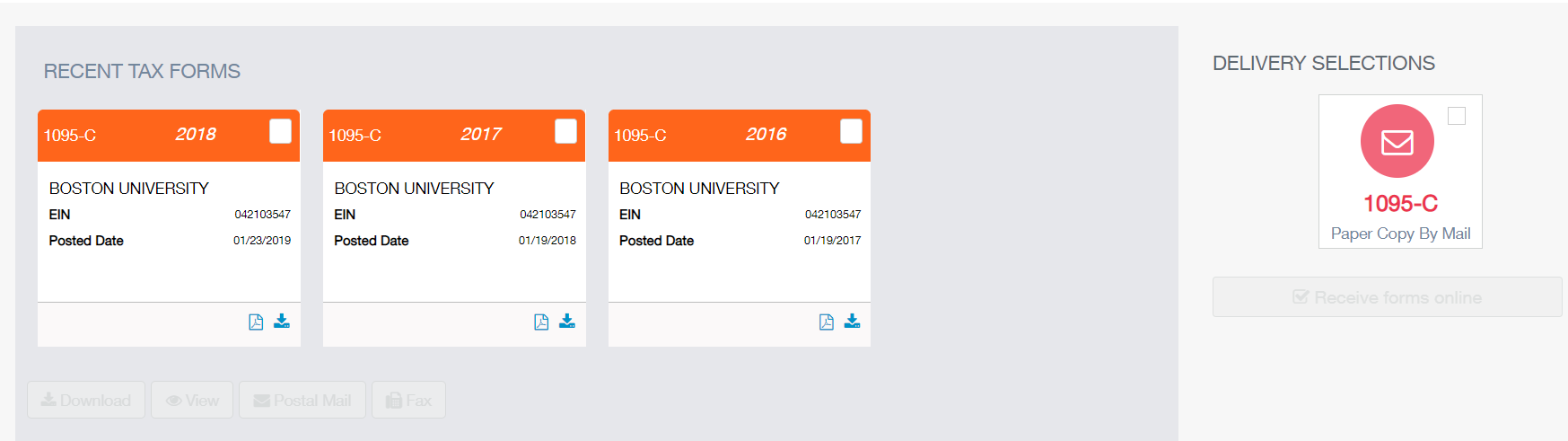

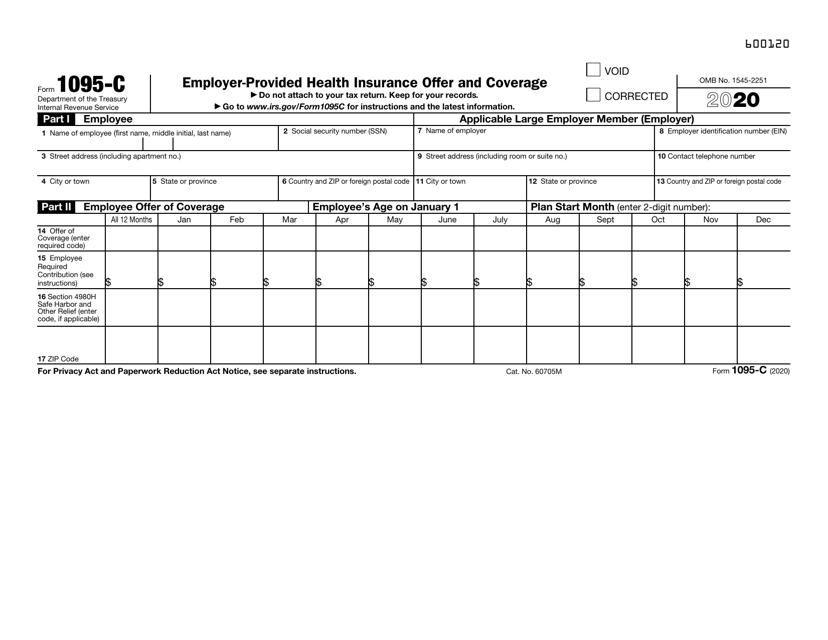

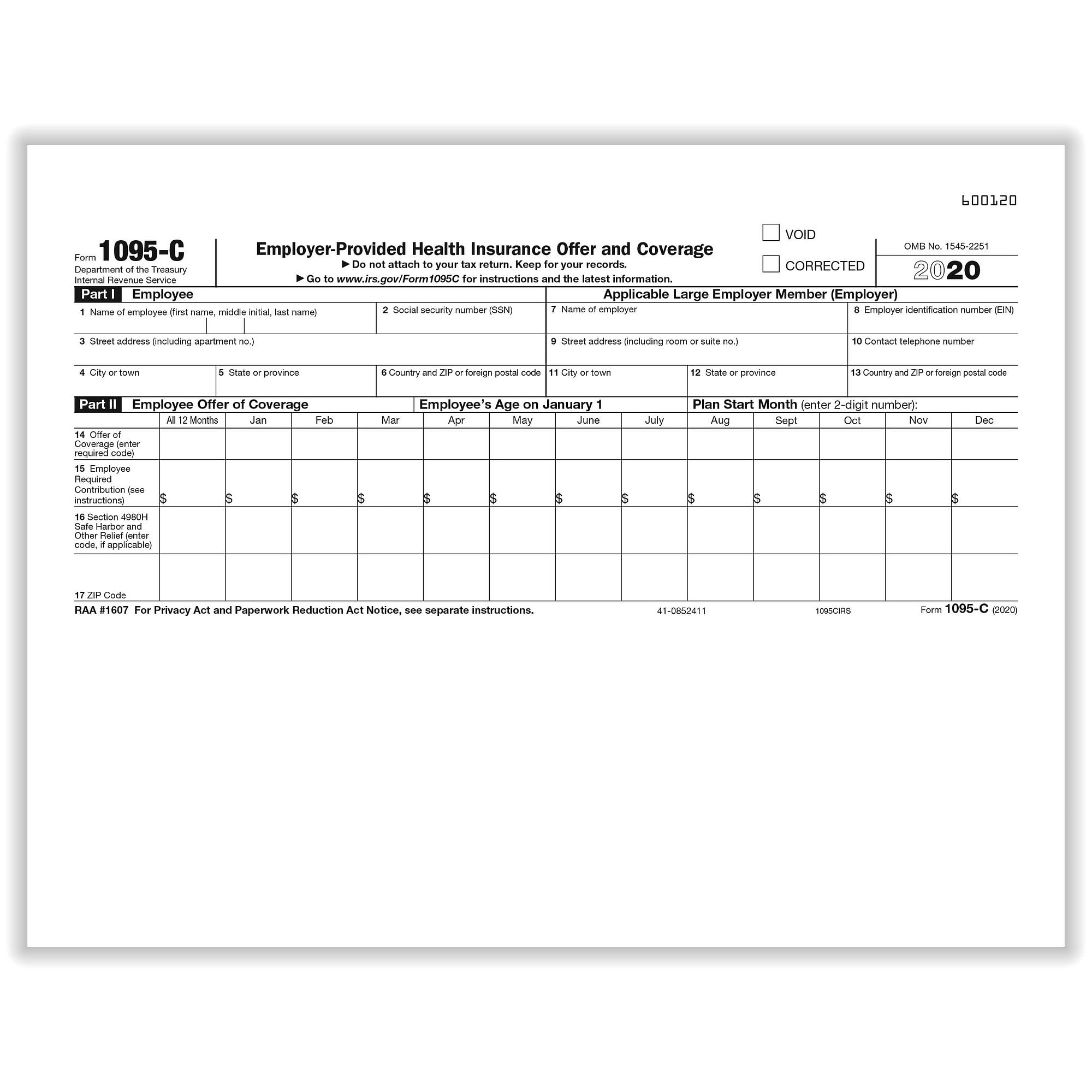

1095 c form 2020 reporting-There is no longer a federal mandate to have health insurance and you do not have to file Form 1095C on your Tax return Prepare and eFile Your Taxes here on eFilecom 1095C If you and/or your family receive health insurance through an employer, the employer will provide Form 1095C by early March 21Form 1095C EmployerProvided Health Insurance Offer and Coverage 19 Form 1095C EmployerProvided Health Insurance Offer and Coverage 18 Form 1095C EmployerProvided Health Insurance Offer and Coverage 17 Form 1095C EmployerProvided Health Insurance Offer and Coverage

Instructions For Forms 1095 C Taxbandits Youtube

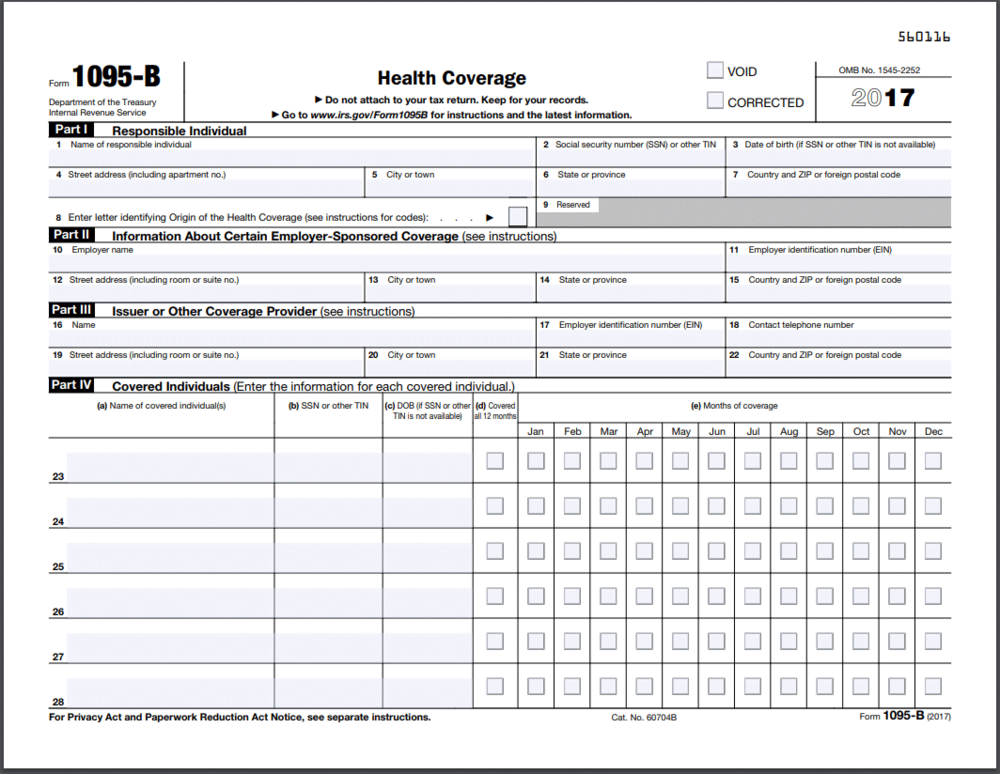

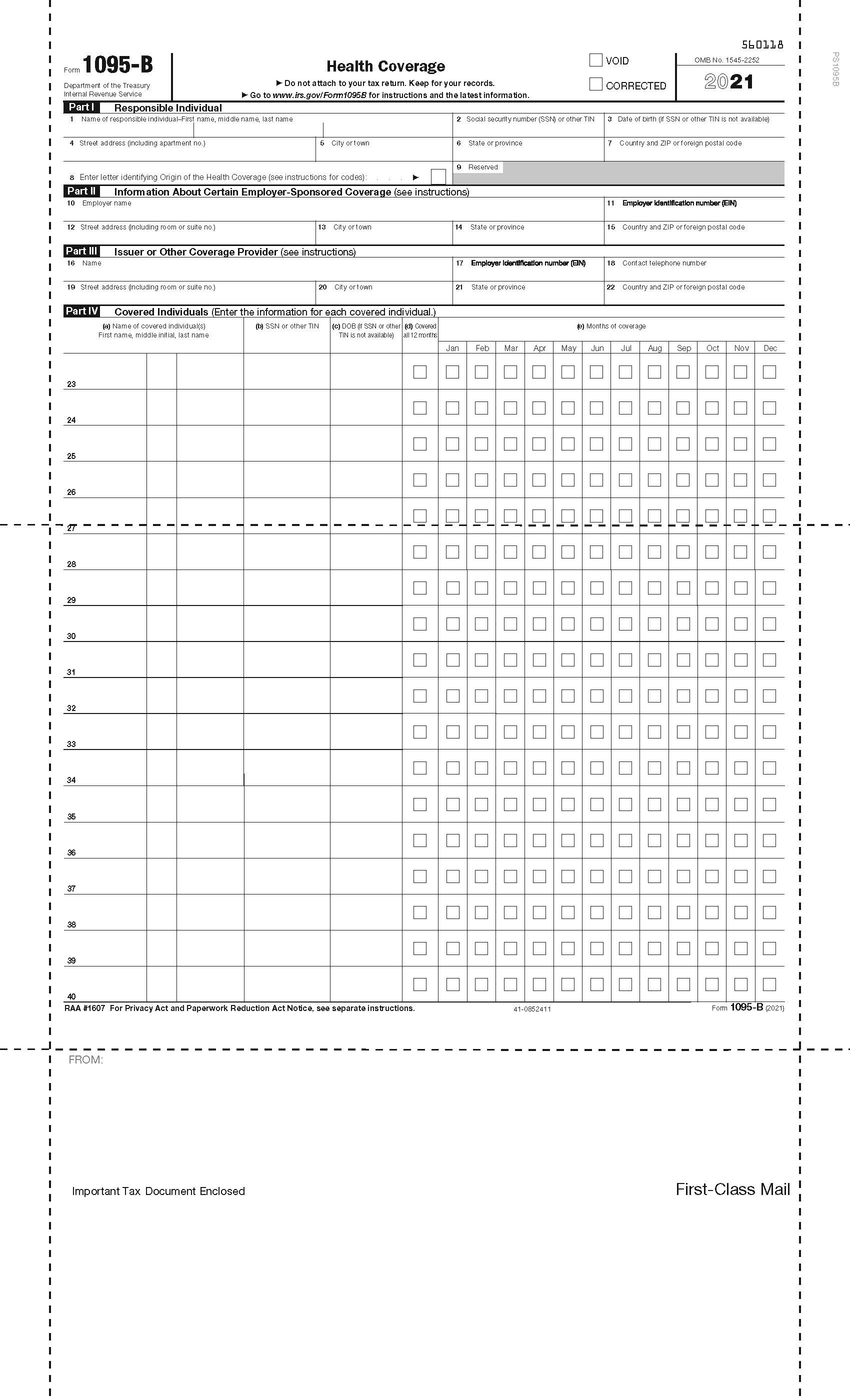

Form 1095C Decoder If you were a fulltime employee working 30 or more hours per week or enrolled in healthcare coverage from your employer at any point in , you should receive a Form 1095C If you received a Form 1095C from your employer and you're not sure what the codes mean, check out our 1095C Decoder to learn moreThe IRS supports both paper and electronic filing for the tax year The due date for filing Form 1095C is given below Form 1095C due date forForm 1095C EmployerProvided Health Insurance Offer and Coverage Form 1095B Health Coverage Inst 1095A Instructions for Form 1095A, Health Insurance Marketplace Statement Form 1095A

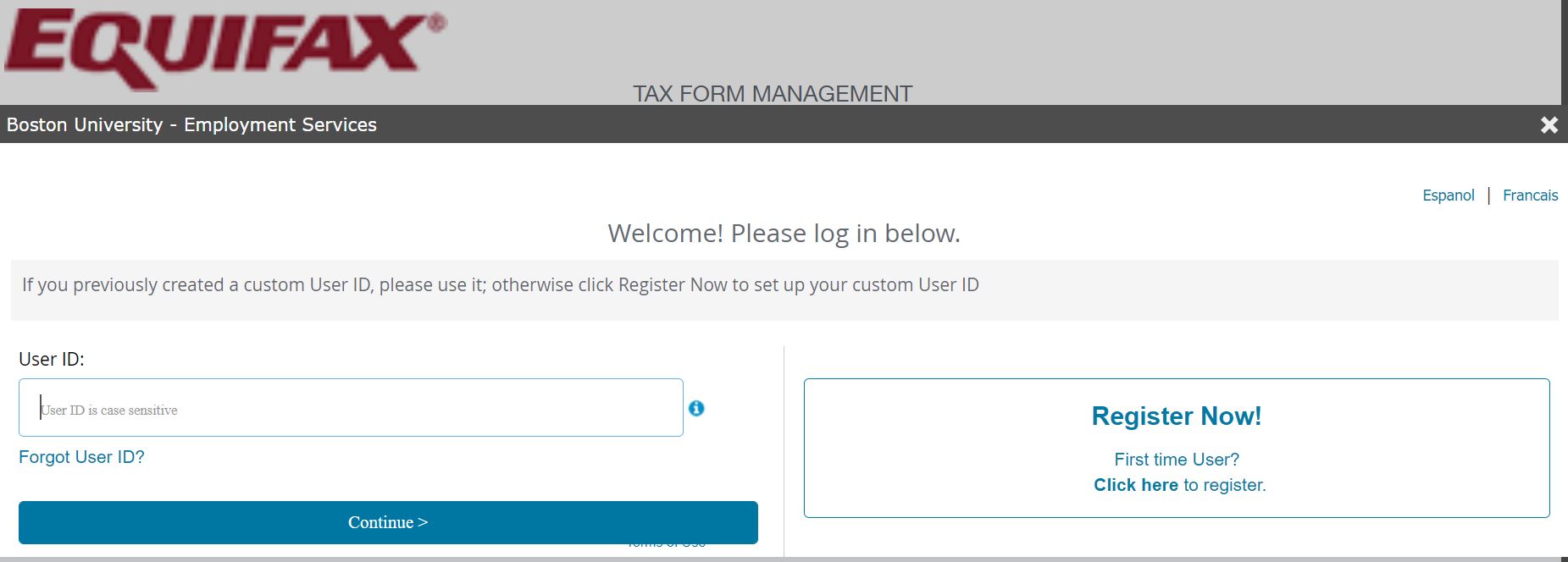

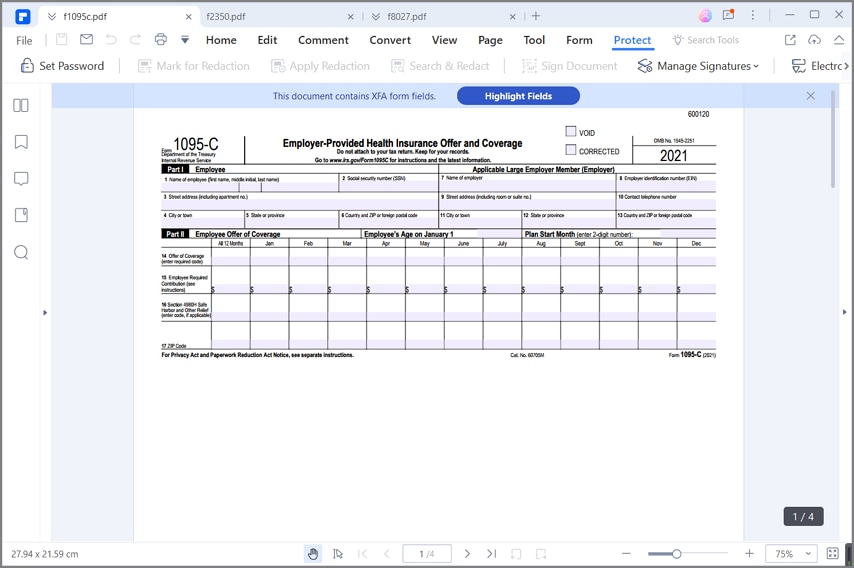

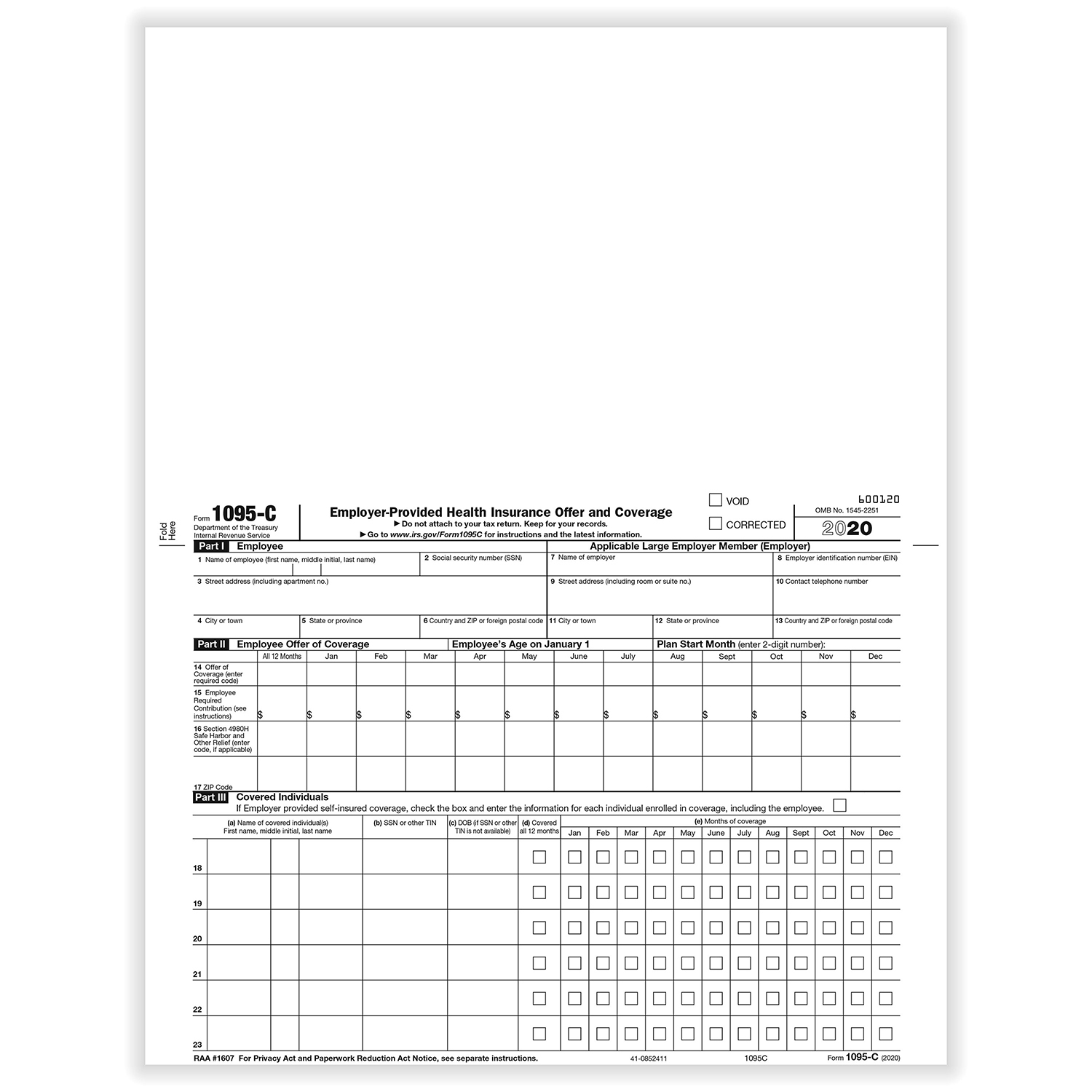

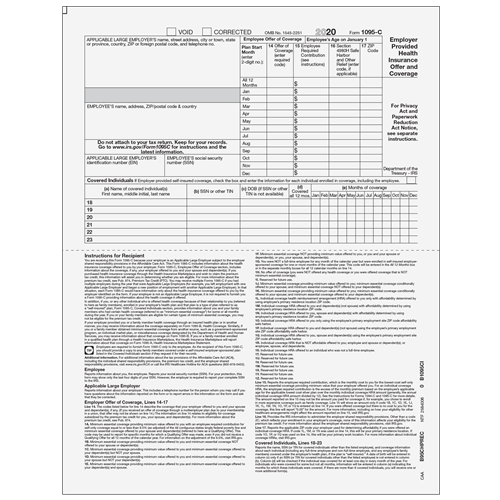

This box is required for the Form 1095–C and the ALE Member may not leave it blank To complete the box, enter the twodigit number (01 through 12) indicating the calendar month during which the plan year begins of the health plan in which the employee is offered coverage (or would be offered coverage if the employee were eligible toThe copy of Form 1095C must be sent to the employees To learn more about the 1095C Form, visit wwwirsgov Click here to learn more about Form 1095 C for Tax Year When is the due date to file Form 1095C?Your 1095C Tax Form for You will soon receive your 1095C via US Mail for the tax year containing important information about your health care coverage Employers are required to provide the 1095C to the following employees as part of the Patient Protection and Affordable Care Act Employees enrolled in the Boston University Health

The Form 1095C is the EmployerProvided Health Insurance Offer and Coverage, designed by the IRS to capture enough information about the employer's offer of• Cook County is providing a Form 1095C to employees that worked, or were hired to work, at least 1,560 hours (130 hours per month) prior to Open Enrollment This includes employees who may have terminated employment during • The Countyprovided Form 1095C contains information in Part II—Employee Offer and CoverageReceive a Form 1095C in February Employees should check Employee Self Service ("ESS") in order to obtain Form 1095C, or contact their payroll personnel See Question C for the IRS definition of a "fulltime" employee Note The Form 1095C shows the IRS that the City offered

Changes Coming For 1095 C Form Tango Health Tango Health

Download Instructions For Irs Form 1094 C 1095 C Pdf Templateroller

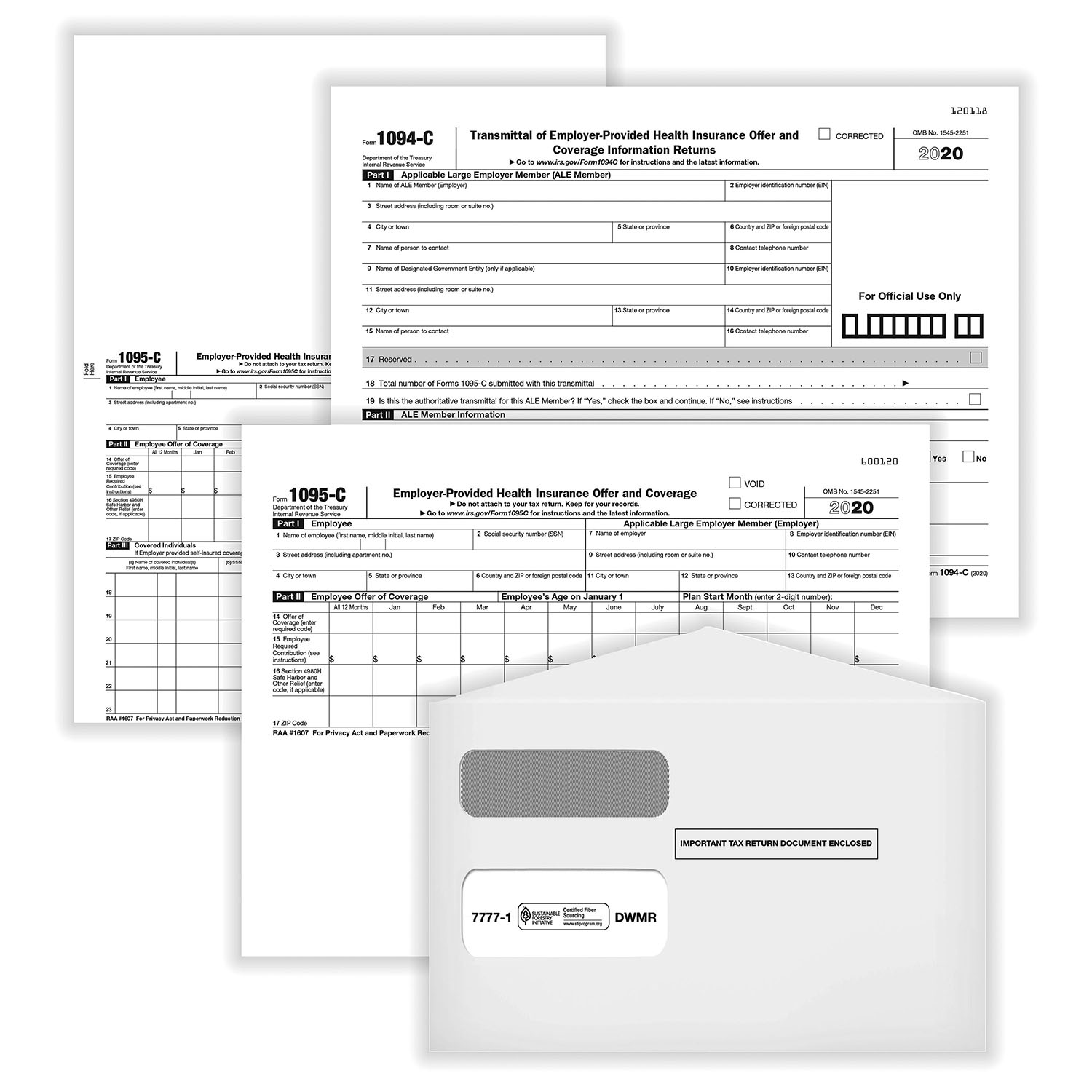

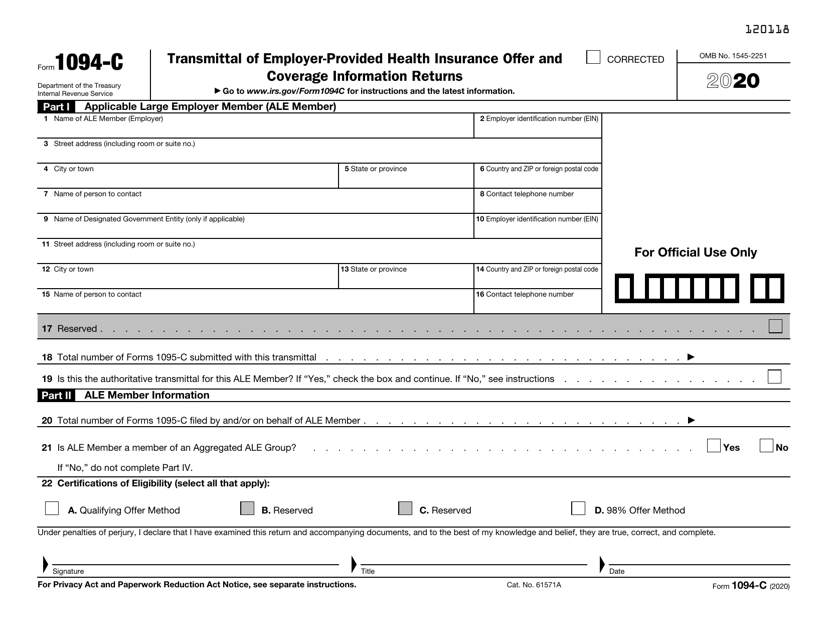

No M Form 1095C () Form 1095C () Instructions for Recipient You are receiving this Form 1095C because your employer is an Applicable Large Employer subject to the employer shared responsibility provisions in the Affordable Care Act This Form 1095C includes information about the health insurance coverage offered to you by yourInstructions for Forms 1094C and 1095C 14 Form 1094C Form 1094C Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns 19 Form 1094C Filed my tax return and later that week received a 1095C from work I forgot I had signed up for anything as it was never used and I am on my parents insurance (I am 24) Will this affect my return at all as I do not think I checked off anything regarding receiving insurance from work?

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

What Is An Irs Form 1095 C Boomtax

Not filing it for will not affect subsidy eligibility in future years)1095C Form Download ACAPrime "C Forms" Template Download ACAPrime "B Forms" Template Check out the details for ACA reporting for employers by Individual US State ACAPrime Template Tutorial (12 min) Video is for C Forms Be sure to click the Full Screen Box to the bottom right for optimal viewingFederal employees and annuitants with Federal Employees Health Benefits (FEHB) coverage will soon receive the Internal Revenue Service (IRS) Forms 1095B and 1095C The information contained on these forms will help you complete your tax return If you are enrolled in FEHB, your health plan will send an IRS Form 1095B to you and will

Instructions For Forms 1095 C Taxbandits Youtube

Employer Aca Reporting Final Forms Lawley Insurance

If you didn't receive an initial Form 1095C and you were employed by Harvard and/or were enrolled in one of the Harvardsponsored medical plans during the calendar year, you can contact the Benefits office at (or by email at benefits@harvardedu) to request a duplicate FORM 1095C FAQ SApache/2441 (Ubuntu) Server at semoedu Port 443 Other Recent Form 1095C Changes to Filing Instructions In , the IRS introduced a handful of other changes to ACA reporting forms These included Plan Start Month All Applicable Large Employers (ALEs) must enter a twodigit code on Form 1095C Age and ZIP Code Inclusion If an employee was offered an ICHRA, employers must enter the

1095 C Preprinted Portrait Version With Instructions On Back

Aca Codes A 1095 Cheat Sheet You Re Gonna Love Thread Hcm

Form 1095C's for the University of Pittsburgh employees for the tax year are to be mailed in January 21 If you believe you should have received a Form 1095C but did not, please contact the University of Pittsburgh's Benefits DepartmentMinimum essential coverage not offered to dependent(s) (See Conditional offer of spousal coverage, for anWhen the 1095C must go out Sending out 1095C forms became mandatory starting with the 15 tax year Employers send the forms not only to their eligible employees but also to the IRS Employees are supposed to receive them by the end of January—so forms for 21 would be sent in January 22

Irs Extends Deadline For Furnishing Form 1095 C To Employees Extends Good Faith Transition Relief For The Final Time Hmk

Obamacare Tax Forms In The Time Of Coronavirus Don T Mess With Taxes

Inst 1094B and 1095B Instructions for Forms 1094B and 1095B Form 1094C Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns Inst 1094C and 1095CForm 1095C is not required to be filed with your tax return If you had fullyear coverage for , no action needs to be taken with Form 1095C If you did not have fullyear coverage, use the information on Form 1095C to report the months of coverage you did have, To review all of your health insurance entries From within your TaxAct return (Online or Desktop), click FederalTax1099 is the goto source for your tax information reporting with IRS You can eFile Form 1095C Online for the year using Tax1099

Form 1095 A 1095 B 1095 C And Instructions

1095 C Form 21 22 Finance Zrivo

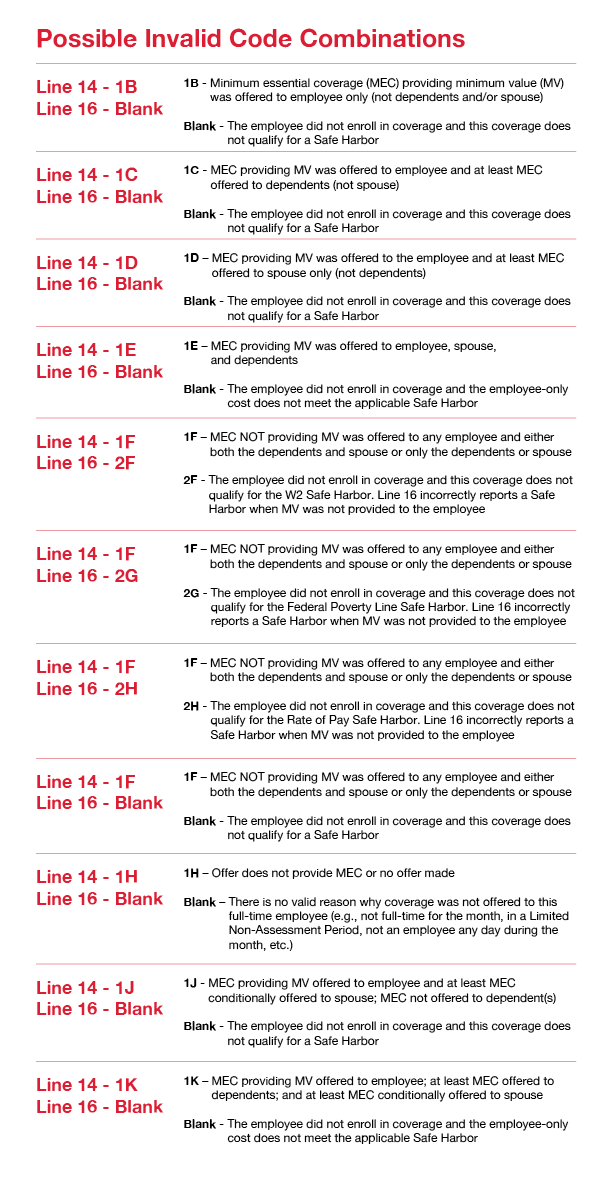

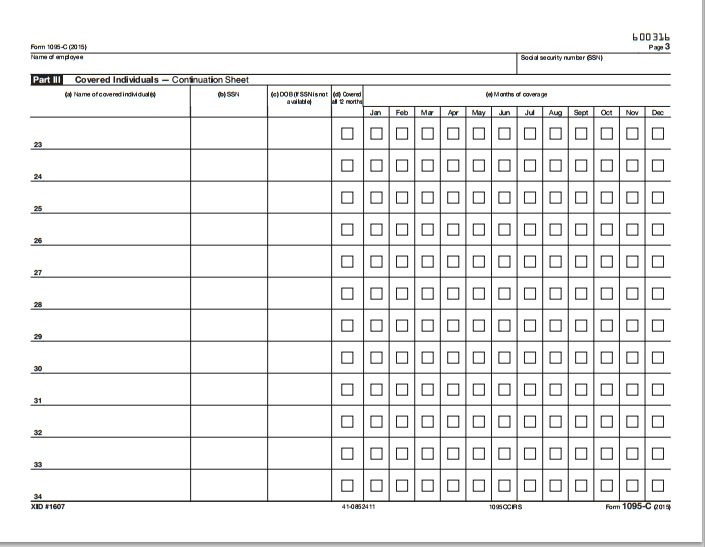

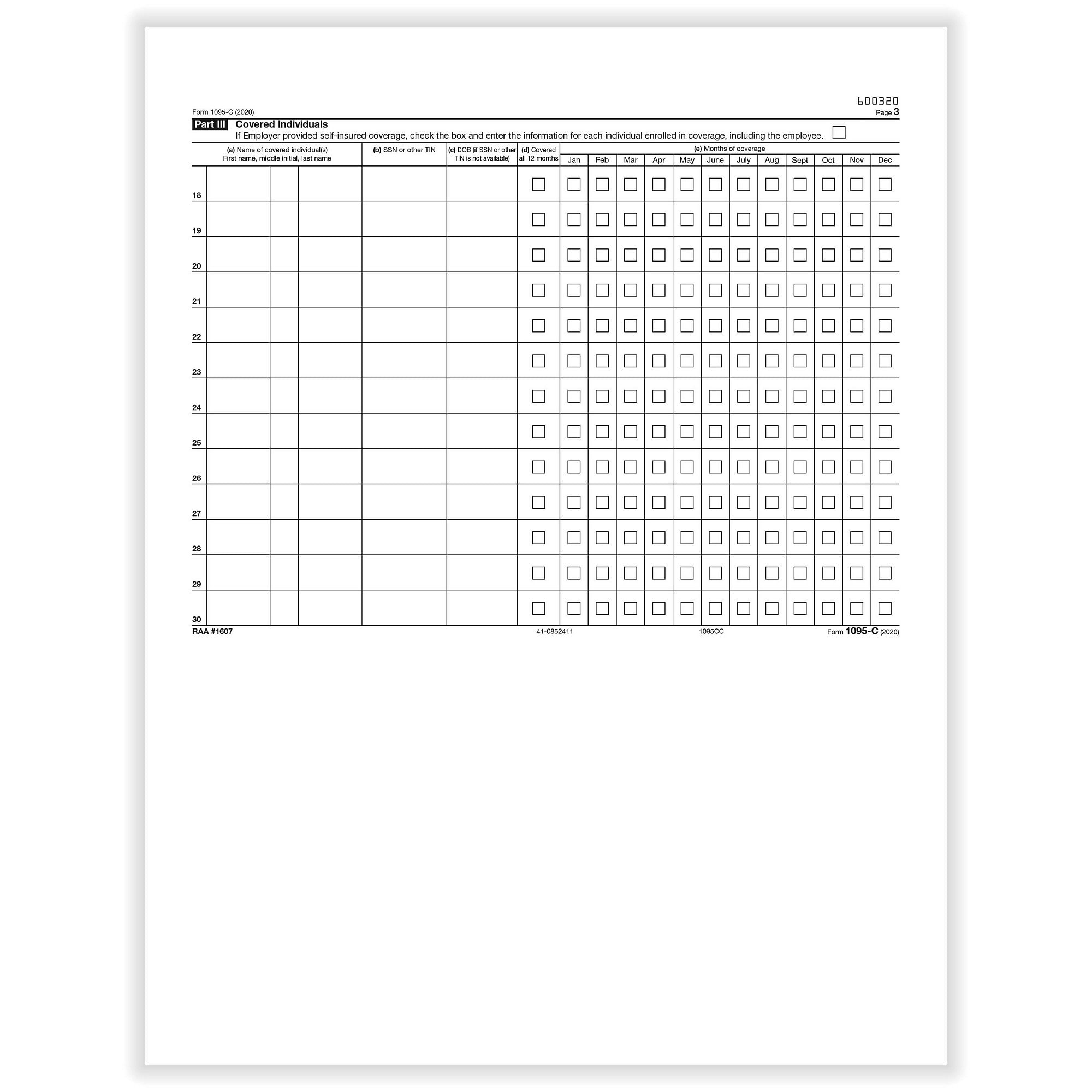

When populating Form 1095C, employers are communicating a lot of information through a series of codes on Lines 14 and 16 It is incredibly important for an employer to have documentation supporting the codes they are using when populating the Forms 1095C Below is a general breakdown of the different codes that could be entered on Lines 14This Form 1095C, you should provide a copy to any family members covered under a selfinsured employersponsored plan listed in Part III if they request it for their records Additional informationMuch like the Form W2 is used to determine whether or not you owe taxes, the IRS will use the information reported from your Form 1095C to confirm healthcare coverage Think of the form as your "proof of insurance" for the IRS If you enrolled in healthcare coverage at any time in , you will receive a Form 1095C from the College

1095 C Tax Form For Gwell

Form 1095 A 1095 B 1095 C And Instructions

Form 1095C contains information about the health coverage offered by your employer in This may include information about whether you enrolled in coverage Use the information contained in the 1095C to assist you in determining in you are eligible for the premium tax credit How to eFile 1095C for the Year ?This is required for the Form 1095C The Applicable Large Employer (ALE) must enter a twodigit number Additional Information For information related to the Affordable Care Act, visit IRSgov/ ACA For the final regulations under section 6056, Information

1095 C Form 21 22 Irs Forms

Form 1095 C Guide For Employees Contact Us

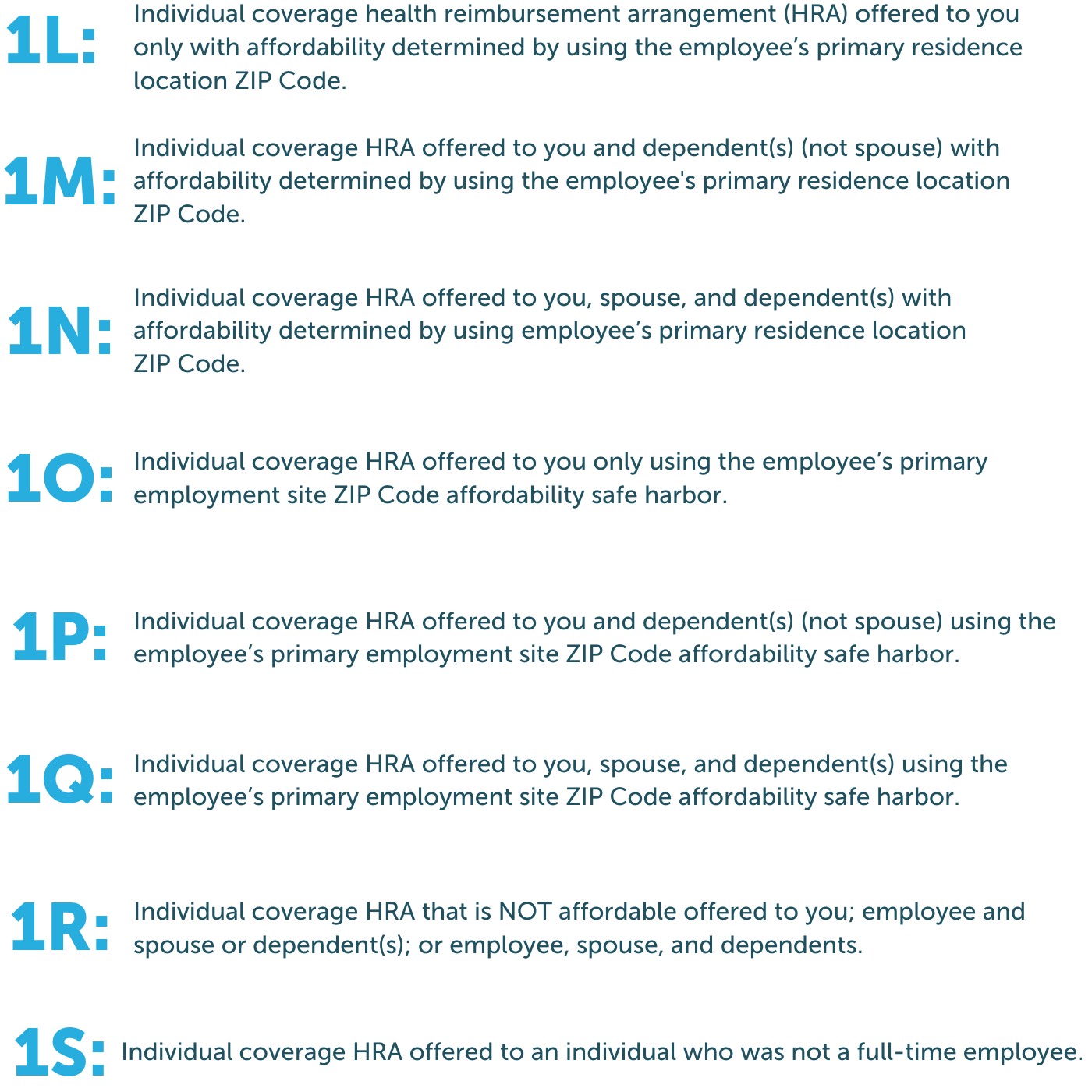

The IRS has released drafts of 22 IRS Forms 1095C in the month of May The drafts have clearly defined the expansion of ACA Reporting to accommodate the newly included ICHRA plans With an ICHRA (Individual coverage health reimbursement arrangements), an employer provides a class of employees with a monthly allowance that can be used to purchase individual health coverage Form 1095C is not required to file your tax return In late February 21, the Health Care Authority (on behalf of your employer) will mail Forms 1095C to state agency, highereducation, and commodity commission employees enrolled in Uniform Medical Plan (UMP) Employees determined "fulltime" under Affordable Care ActForm 1095C (21) Page 2 Instructions for Recipient You are receiving this Form 1095C because your employer is an Applicable Large Employer subject to the employer shared responsibility provisions in the Affordable Care Act This Form 1095C includes information about the health insurance coverage offered to you by your employer Form 1095C, Part

Ez1095 Aca Form Software How To Import 1095 C Data From Spreadsheet

Irs Issues Draft Form 1095 C For Aca Reporting In 21

Series 1 and Code Series 2 in lines 14 and 16 of Form 1095C The IRS will then review the codes used and determine whether you are compliant with your employer mandate ACA requirements ACA FORM 1095C CODE SERIES The IRS has designed two sets of ACA codes to provide employers with a way to describe health coverage offers on Form 1095CCODES FOR IRS FORM 1095C CODE SERIES 1 (continued) 1J Minimum essential coverage providing minimum value offered to employee and at least minimum essential coverage conditionally offered to spouse;*Updated for tax year 16 In January, aside from receiving your usual Form W2 from your employer, you may receive Form 1095C related to the Affordable Care Act (ACA) If you received health insurance outside of the marketplace exchanges in and worked for a large employer, look for Form 1095C, EmployerProvided Health Insurance Offer and Coverage, to arrive in

19 Aca Reporting Timeline Pomeroy Group

Human Resources Forms Home Garden 1095 C Blank Full Page Form W Instructions On Back For 50 Recipients Sklep Amstii Pl

Other Recent Form 1095C Changes to Filing Instructions In , the IRS introduced a handful of other changes to ACA reporting forms These included Plan Start Month All Applicable Large Employers (ALEs) must enter a twodigit code on Form 1095C Age and ZIP Code Inclusion If an employee was offered an ICHRA, employers must enter the The new form covers HRA plan years starting New codes for the 1095C For tax year , Form 1095C gets updated with brandnew offer codes employers can enter in line 14 You'll use it to indicate the type of HRA coverage offered to employees The information on Form 1095A is used to complete Form 62 (again, Form 62 is not required for if you would have had to repay some or all of the premium tax credit;

What Are The Differences Between Form 1095 A 1095 B And 1095 C

1095 C Employer Provided Health Insurance Irs Copy For 21 5098b Tf5098b

Updated October On , the IRS extended the due date for the form 1095C reporting requirements This means that the original deadline for issuing form 1095C to employees has moved from to Penn State plans to have the 1095C forms mailed out to individuals by no later than the extended deadline date ofIRS Form 1095C is used by Applicable Large Employers (ALEs) to report the health insurance coverage information provided to their fulltime employees and employee's dependents For the tax year , form 1095C has been updated And, employers should use the updated 1095C form to file with the IRS this yearACA Form 1095C Codes Sheet An Overview Updated 800 AM by Admin, ACAwise The IRS requires ALEs to report their employee's health coverage information on Form 1095C

1095 C Vs 1095 A

Amazon Com Next Day Labels Pressure Seal Tax Forms 1095 C 8 1 2 X 14 Office Products

2

Integrity Data The Irs Has Extended The Deadline For Distributing Form 1095 C To Employees From January 31 To March 2 Get All The Details From The Irs Here

Ez1095 Aca Form Software How To Import 1095 C Data From Spreadsheet

1095 C Print Mail s

Irs Final Aca Compliance Forms Now Available Bernieportal

/1095b-741f9631132347ab8f1d83647278c783.jpg)

Form 1095 B Health Coverage Definition

Your 1095 C Tax Form My Com

Eleven Irs Form 1095 C Code Combinations That Could Mean Potential Penalties

1095 C Form Official Irs Version Discount Tax Forms

What You Need To Know About Aca Annual Reporting Aps Payroll

2

Irs Extends Deadline For Furnishing Form 1095 C Extends Good Faith Transition Relief Fedeli Group

Irs Form 1095 C Uva Hr

1095 C Faqs Mass Gov

What Are The Form 1094 C And 1095 C Requirements For Fully Insured Health Plans In

Irs Distribution Deadline January 31 22 Aca Gps

Irs Releases Form 1095 With Changes For Ichra Plans Health E Fx

Your 1095 C Tax Form For Human Resources

Irs Issues Draft Form 1095 C For Aca Reporting In 21

Ingroup Associates Legal Alert Irs Extends Deadline For Furnishing Form 1095 C To Employees Facebook

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

Ty Draft Forms 1095 C And 1094 C Released Along With New Form 1095 C Codes Press Posts

2

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

Aca Reporting For Usi Insurance Services

Let S Look At The Most Common 1095 C Coverage Scenarios Integrity Data

:max_bytes(150000):strip_icc()/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

Affordable Care Act Form 1095 C Hrdirect

Centerpoint Payroll Affordable Care Act Aca Forms Prepare And Print And Or Efile

Irs Releases Aca Forms 1094 C And 1095 C Final Instructions

Irs Final Aca Compliance Forms Now Available Bernieportal

Affordable Care Act Setup

The Instructions For Forms 1094 C And 1095 C Blog Taxbandits

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

1095 C 1094 C Aca Software To Create Print E File Irs Form 1095 C

Irs Form 1094 C Download Fillable Pdf Or Fill Online Transmittal Of Employer Provided Health Insurance Offer And Coverage Information Returns Templateroller

Form 1095 And The Aca Office Of Faculty Staff Benefits Georgetown University

Irs Form 1095 C The Best Way To Fill It Out Wondershare Pdfelement

1

Irs Extends Deadline For Furnishing Form 1095 C To Employees Woodruff Sawyer

3

1095 Form 1095 Employer Provided Health Insurance Formstax

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

Aca Forms

1095 C Envelope Printing Selection Criteria For The Use Of A W 2 Style Envelope Integrity Data

Form 1095 C Mailed On March 1 21 News Illinois State

Annual Health Care Coverage Statements

Form 1095 C Adding Another Level Of Complexity To Employee Education And Communication The Staffing Stream

Form 1095 A 1095 B 1095 C And Instructions

Accurate 1095 C Forms Reporting A Primer Integrity Data

Your 1095 C Tax Form For Human Resources

Irs Govform1095a Employer Provided Health Insurance Offer In Pdf

Accurate 1095 C Forms Reporting A Primer Integrity Data

Preprinted 1095 C Half Page Form B95chprec05

Irs Form 1095 C Codes Explained Integrity Data

1095 C Reporting How To Use Affordability Safe Harbors For Integrity Data

Code Series 2 For Form 1095 C Line 16

New 1095 C Codes For Tax Year The Aca Times

1095 C Submit Your 1095 C Form Onlinefiletaxes Com

Irs Form 1095 C Download Fillable Pdf Or Fill Online Employer Provided Health Insurance Offer And Coverage Templateroller

Changes Coming For 1095 C Form Tango Health Tango Health

1095 C Continuation Forms Official Irs Version Zbp Forms

1

Ez1095 Aca Form Software How To Import 1095 C Data From Spreadsheet

Form 1095 C Forms Human Resources Vanderbilt University

Form 1095 C Now Available Online At My Vu Benefits News Vanderbilt University

Updates To Form 1095 C For Filing In 21 Youtube

The New 1095 C Codes For Explained

1095 C Form Health Coverage The Supplies Shops

Irs Form 1095 C Fauquier County Va

Form 1095 C Released New Codes New Deadlines

Irs 1095 Forms And Instructions Fill Pdf Online Download Print Templateroller

Explanation Of 2d On Line 16 Of The Irs 1095 C Form Integrity Data

1095 C Employer Provided Health Insurance Offer And Coverage Continuation Form 300 Sheets Pack

1095 C Tax Form 35 Images Let Your Employees About The New Tax Reporting Forms 1095 Confused About Irs Health Coverage Form 1095

Employers Are You Unsure Of The Coding On Forms 1094 C And 1095 C The Aca Times

Changes Coming For 1095 C Form Tango Health Tango Health

Sample 1095 C Forms Aca Track Support

2

Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller